Economic quarterly | June 2025

21 Jul 2025, 2:45 PM

What's trending

Northland’s job market: What’s changing and who’s affected?

Northland’s annual unemployment rate has edged up again, making it the highest in the country, but, the story behind the numbers is what really matters.

We’ve unpacked what’s going on, how it compares to other regions, and why it’s happening now

- Northland’s unemployment rate rose to 6% in March 2025, up from 4.7% a year earlier.

- This increase was driven by:

- A drop in employment of around 2,200 people

- A rise in jobseekers (approx. 1,000 more people looking for work)

- The unemployment rate didn’t rise as much as it could have because about 1,000 people stopped looking for work and were no longer counted in the labour force.

- Northland now has the highest unemployment rate in the country, just above Waikato, Bay of Plenty and Auckland.

- This is the first time since before COVID-19 that Northland has topped the regional unemployment list.

- Still, the current rate is well below the 2010s average of 8%.

- The region has followed a national trend:

- Spike during COVID

- Drop to historic lows in 2022–2023

- Rise again in 2024 to pre-pandemic levels

- Otago is the only region where unemployment hasn’t returned to pre-COVID levels.

Who’s being affected most?

- Māori workers

- 2,000 fewer Māori in work compared to March 2024, representing 6.5% drop in Māori working, and 95% of the drop in employment.

- Māori unemployment now sits at nearly 12%, compared to 3% for non-Māori

- Men are more affected than women

- This could be explained by the slowdown in construction, a sector that employs many Māori men

- Construction jobs tend to fluctuate more than roles in sectors like health or education

What's changed

Decrease in residential consents

Northland has seen a sharp 31% drop in residential building consents over the past year, the biggest fall in the country.

The numbers point to growing pressure on the construction sector and housing supply, with potential impacts on jobs and the local economy. We look at the numbers behind the drop.

Residential consents in Northland declined by 31 percent in the year to March 2025, dropping from 1,028 in March 2024 to 714.

This was the largest decline of any region in the country, followed by Wellington with a 20 percent drop and Nelson with a 12 percent decrease. In contrast, Otago recorded a 31 percent increase in residential consents.

Over the past decade, Northland’s annual growth rate in consents has been slow at just 3 percent per year, ahead of only Canterbury, Tasman, and Taranaki.

The recent decline in consents is placing pressure on the construction sector, which is a key part of the regional economy, with potential impacts on employment, investment confidence, and future housing supply. However, monthly data for May 2025 suggests a possible turning point, with a very modest uplift in consents since March.

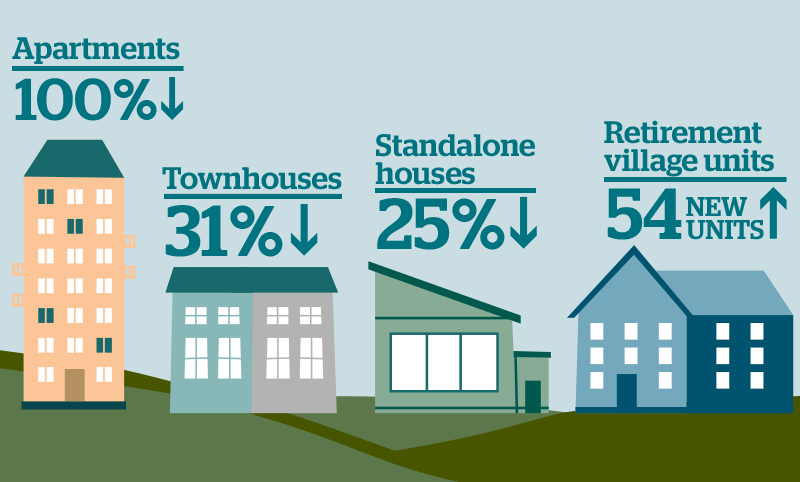

The numbers behind the March drop in consents:

- Apartments: Down 100 percent. No new consents at all.

- Townhouses: Down 31 percent.

- Standalone houses: Down 25 percent.

- Retirement villages: Up 54 units, showing demand for older-age housing.

- Whangārei: Biggest local drop at 40 percent.

- Far North: Down 27 percent.

- Kaipara: Bucked the trend with a 17 percent increase.

- Non-residential consents: Also down, but only by 3.3 percent per year.

Why it matters for Northland

- Construction jobs at risk: Fewer projects could mean job losses, reduced opportunities, and less economic activity.

- Housing market under strain: Real estate listings in Northland are down 8%, while nationally they’re up 14%.

- Northland was the only region to see a drop in listings.

The future of Northland’s development

Northland’s steep drop in building consents raises concerns about housing supply, construction sector stability, and economic growth.

While Kaipara bucks the trend, the broader downturn signals ongoing pressures from rising costs, less demand, and market conditions.

Policy and investment decisions will play a key role in shaping what comes next. It is hoped that this is a temporary slowdown rather than a lasting shift in Northland’s housing supply.

What's new

Housing challenges in New Zealand (Stats NZ)

Housing in Northland 2025: Uneven progress, rising pressures

Housing shows us where inequality lives but it can also be part of the solution.

The latest Housing in Aotearoa New Zealand: 2025 report from Stats NZ paints a mixed picture for Northland. The region is still facing serious housing challenges, but there are also signs of slow progress.

Housing trends across New Zealand

It’s important to look at the wider picture before narrowing down into a region. The Housing in Aotearoa 2025 report shows key trends affecting housing across the country.

From 2013 to 2023, housing density increased in every region. There was a 37.6% rise in joined dwellings, and more than one-third of all homes were built after the year 2000.

Housing is still hard to afford. Nearly half of all renting households spend more than 30% of their income on housing.

Many homes are still not up to standard. Over 18% were reported as damp, and disabled people often live in poorer housing conditions.

Severe crowding has gone up, now affecting 6.2% of households. In 2023, more than 112,000 people were estimated to be living in severe housing deprivation.

These trends, including the increase in alternative and temporary housing, show the growing and complex housing needs across the country. Northland is likely facing similar pressures.

Here’s what the data tells us:

- House prices vs incomes:

- In 2024, the median house price in Northland was $655,000. The median household income (household equivalised disposable income after costs) was just $33,684.

- At a 20% savings rate, it would take the average household 10 years to save a 10% deposit — the same as the national average.

- Damp homes improving:

- In 2018, Northland had the highest rate of damp homes in the country (27.6%).

- That’s dropped to 24.7% in 2023 — now second-highest after Gisborne.

- Heating and cold homes:

- 3.5% of homes still rely on portable heaters.

- 4.1% of homes have no heating at all — just behind Auckland at 5%.

- Unfit housing and crowding:

- Northland and Auckland have the most improvised dwellings — 375 and 408 homes.

- The Far North and Whangārei districts top the national list for these types of housing.

- The Far North also has the fifth-highest rate of household crowding (9.4%) and the second-highest rate of people living without shelter (74.2 per 10,000).

- Severe housing hardship:

- It is estimated that in 2023, 3% of Northlanders lived in severe housing deprivation, the same as in 2018. Māori are disproportionately affected, making 61% of those in severe housing deprivation.

But it’s not all bad news:

- Dampness is going down.

- Government is getting better at identifying housing needs and starting to respond — like through the Going for Housing Growth initiative.

What's coming up

AI and the future of Northland's food system

Imagine a world where farmers receive hyper-local weather forecasts, cows wear smart collars to monitor their health, and robots sort fruit with the precision of a chef – all thanks to AI.

AI is already transforming the global food system. From planting to plate, AI is helping optimise production, reduce waste, and improve efficiency.

Globally, machine learning is being used to predict crop yields, automate harvesting, and even detect plant diseases. In food processing, AI ensures quality control and streamlines supply chains and is being used to help minimise delays and waste.

What does this mean for New Zealand and more importantly, Te Taitokerau, Northland?

AI offers opportunities but, barriers for the rohe remain, like adoption, cost and ensuring AI aligns with Northland’s unique needs.

Global surge in AI investment

AI investment has skyrocketed over the past decade. It grew from US$3.2 billion in 2013 to a projected US$158.4 billion by 2025 which is a huge 42.5% annual growth rate. By late 2024, the market had already hit US$184 billion.

Projections suggest it could reach US$826 billion by 2030 and US$1.3 trillion by 2032. The United States and China are leading the charge, but the ripple effects are being felt worldwide, including in New Zealand.

A game-changer for Northland’s primary sector

Northland’s economy relies heavily on its primary industries. In 2024, agriculture, forestry, and fishing made up 10 percent of the region’s GDP and employed 9.5% of filled jobs.

AI offers powerful tools to support these sectors – think machine-learning models improving soil health and irrigation, drones monitoring crop maturity to automated quality control in food processing.

In aquaculture in Northland, AI is already improving stock tracking and sustainability, predicting high-yield fishing areas, and reducing environmental impacts.

In forestry, it’s helping with species identification, carbon tracking, and wildlife prediction, making their operations more sustainable.

The risk of a digital divide

The benefits of AI are not evenly distributed. Large agribusinesses are adopting AI rapidly, while smaller farms often lack the resources to keep up. This digital divide could leave traditional operators at a disadvantage.

This divide is exacerbated by the uneven distribution in digital connectivity across the region. Investment in Northland’s digital infrastructure is essential for AI to function effectively.

In manufacturing, limited economies of scale and a small domestic market make it harder to justify investment in AI. Yet for export-focused businesses, AI is becoming essential to stay competitive. Without action, Northland risks being left behind.

Positioning Northland for AI success

To unlock AI’s potential, Northland needs a coordinated strategy. This includes investing in digital infrastructure, supporting collaboration between industry and research, and building digital capability across the region. AI is not just about automation. It is about smarter decisions, sustainable practices, and securing Northland’s place in the global food and fibre economy.

The future of food is already being shaped by AI. The question is no longer if Northland will be affected, but how well it will adapt.

Check out the Brightseed – Forager Casestudy (PDF, 416KB)

AI in New Zealand’s agri-tech scene

New Zealand is home to some pretty clever companies using artificial intelligence to make farming smarter, more efficient, and better for the environment. Here’s a look at a few of them:

Allflex started right here in New Zealand but now has its headquarters in the US. They’re known for their high-tech livestock tags that do more than just ID animals — they track their movements and health in real time using AI. This helps farmers spot issues early and make better decisions for their herds.

Halter, based in New Zealand, has developed smart collars for cows. These collars use GPS and virtual fencing to guide cattle around paddocks without the need for physical fences. The AI behind it helps manage grazing patterns, making sure pasture is used efficiently and animals stay healthy. They’ve already raised nearly US$100 million in funding.

LIC Limited is a well-established, farmer-owned co-op that’s been using AI to improve herd genetics and productivity. Their tools help farmers breed more efficient animals, which is good for both the environment and the bottom line.

Hectre is bringing AI into the orchard. Their technology looks at things like weather, soil, and crop health to help fruit growers make smarter decisions about watering, pest control, and when to harvest. They’re still a startup but have already raised over US$3 million.

Mussel Vision, a project within Sanford, is using sensors and cameras to figure out the best time to harvest mussels. The AI analyses the size and weight of the mussels to make sure they’re top quality before they’re pulled from the water.

CarbonCrop is a New Zealand-based startup that uses artificial intelligence to help landowners measure, monitor, and monetise carbon sequestration in forests. They’ve also raised over US$3 million in seed funding.

Disclaimer: This e-newsletter provides general information on the Northland economy and the views expressed are those of the authors. It is not intended for any course of action nor as a substitute for financial advice.