Economic quarterly | December 2025

8 Dec 2025, 9:45 AM

What's trending

Northland businesses hit record high: Growth and shifts ahead

Bouncing back after tough times

Northland’s business numbers are at their highest on record. The region recorded 24,351 businesses in February 2025, up 1 percent on the previous year. This steady climb from the post-GFC low of 19,700 in 2013 shows long-term resilience. Over the past ten years, Northland has maintained a constant share of total businesses halting the decline experienced from early 2000s to mid-2010s.

Northland’s businesses grew to nearly 25,000 by 2025, while its national share fell to about 3.8%.

How we compare to other regions

From 2020 to 2025, Northland’s businesses grew by about 2.3 percent each year—second fastest in the country after Otago. Over the last 10 years, our growth was about the same as the national average (1.9% per year).

District momentum

Growth of businesses has been strong across the region between 2020 and 2025:

- Kaipara: +15%

- Whangārei: +13%

- Far North: +9%

Business distribution mirrors population:

- Whangārei: 48%

- Far North: 35%

- Kaipara: 17%

This mix reflects where people live and the strength of local business activity.

Big changes in different industries

Structural change is evident in sector trends:

- Information Media & Telecommunications: Grew +46% since 2020

- Financial & Insurance Services: Grew +32% since 2020.

Over the decade:

- Construction: Grew +72% (fastest-growing sector and reshaping regional economy)

Declines:

- Mining: −8%

- Wholesale Trade: −6%

Reflecting national patterns of resource decline and retail restructuring.

National snapshot

- Enterprise growth: 617,330 enterprises nationwide, up 0.5 percent from 2024

- Employment dip: 2.4 million paid employees, down 2.2 percent

- Top employer: Health Care and Social Assistance with 293,600 employees, up 0.8 percent and leading for the fifth year

- Industry shifts: Financial and Insurance Services grew fastest (up 7.7 percent), while construction and retail saw notable employee declines

- Which types of businesses are most common: Rental, Hiring and Real Estate Services held the largest slice at 21 percent of all enterprises.

Economist’s take

Northland has bounced back since the global financial crisis and now has more businesses than ever. Growth has been strong, but other regions are growing even faster.

Kaipara, Whangārei and Far North are all adding businesses. Construction is booming, and finance and tech are growing too. Mining and wholesale trade are shrinking, like in the rest of New Zealand.

Jobs are a different story; many industries are losing workers even as businesses grow. This could be because of technology and changes in how work is done.

What's changed

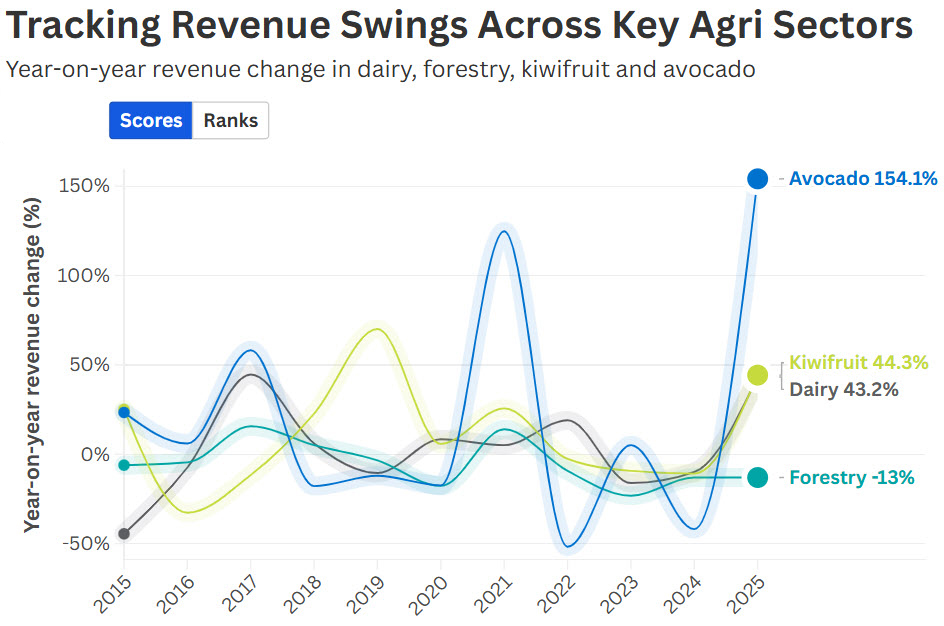

Dairy and horticulture power ahead while forestry slows

Northland’s primary industries showed both strength and pressure in 2024/25. Dairy and horticulture had record-breaking seasons, while forestry continued to face challenges. Across the board, producers dealt with changing markets, variable weather, and shifting consumer demand – highlighting resilience as well as ongoing structural issues.

Forestry is still under pressure, with harvest volumes down and revenue softer, although the area planted in trees continues to grow. Dairy farmers had their best season yet for productivity and enjoyed a sharp lift in payout prices, boosting income across the sector. Kiwifruit bounced back from last year’s weather-hit season with a record crop, accompanied by a long term shift to gold varieties. Avocados had a breakthrough year too, with big gains in yield cementing Northland’s place as the country’s top producing region.

We’ve broken down the stats sector by sector:

Forestry

- Harvest volumes were estimated at 2.5 million cubic metres, down 8 percent on last year and 40 percent below the 2015/16 peak of 4.2 million

- Northland’s share of the national harvest fell to 7.9 percent, compared with nearly 15 percent a decade ago

- The region’s plantation forest area has fluctuated over time, shrinking from around 172,000 hectares in the mid-2000s to below 150,000 in the late 2010s and back up again to over 170,000 hectares

- Forest owners earned about $340 million, down 6 percent on last year, based on an average log price of $131 per cubic metre.

Lower volumes and softer prices continue to put pressure on the sector, despite more land in trees.

Dairy

- Northland’s dairy sector produced 77 million kilograms of milksolids in the 2024/25 season, up 10 percent on the previous year

- This volume is below the historic highs of 90 million kilograms recorded between 2013 and 2015

- However, production per hectare reached a record level, with average output climbing 13 percent to 746 kilograms of milksolids per effective hectare

- Nationally, milksolids production rose 2.9 percent, driven entirely by improved productivity rather than expansion of effective area

- Northland’s share of national production has continued its long-term decline, falling from 6 percent in 2005 to 4 percent in 2025

- The standout was the payout price which surged 30 percent to $10.16 per kilogram of milksolids, lifting Northland dairy farmer revenue by an estimated 43 percent to $782 million.

Kiwifruit

- Northland growers delivered a record harvest of 6.75 million trays in 2024/25, up 57 percent on the previous year

- The rebound was driven by a return to average tray-per-hectare yields after the poor 2023/24 season, which was affected by weak pollination and adverse weather

- The average payment before costs fell 8 percent to $11.82 per tray, but grower revenue surged 50 percent from $78 million to $117 million because of the increase in production

- Gold kiwifruit now makes up 94 percent of Northland’s output, compared with 42 percent in 2005

- Northland contributes 4.5 percent of New Zealand’s kiwifruit producing area and 3.5 percent of national production, reinforcing its role as a niche but strategically important player in the industry.

Avocados

- Northland exported about 1.44 million trays of fruit in 2024/25, a 175 percent increase on the 525,000 trays exported in 2023/24

- The surge was driven by productivity gains rather than land expansion, with producing area up just 4 percent while yield per hectare climbed 163 percent

- The Far North lifted export volumes by 130 percent despite a 7 percent reduction in producing area

- The Mid-North achieved a 340 percent increase in export volumes, supported by a 27 percent expansion in area

- Northland now accounts for 43 percent of New Zealand’s avocado producing area, up from 36 percent a decade ago

- Revenue rose to an estimated $53 million in 2024/25, more than doubling from $21 million in 2023/24, helped by stronger prices.

What it means for Northland

Dairy and horticulture are driving growth, with record productivity and strong returns. Forestry remains under pressure despite more land in trees. These results show the region’s adaptability and resilience, but also highlight the need to plan for sector shifts and long-term sustainability.

Avocado revenue surged 154% in 2024/25 after a very poor 2023/24 season, coupled with strong returns for dairy and kiwifruit; forestry saw a 13% decline.

What's new | On the radar

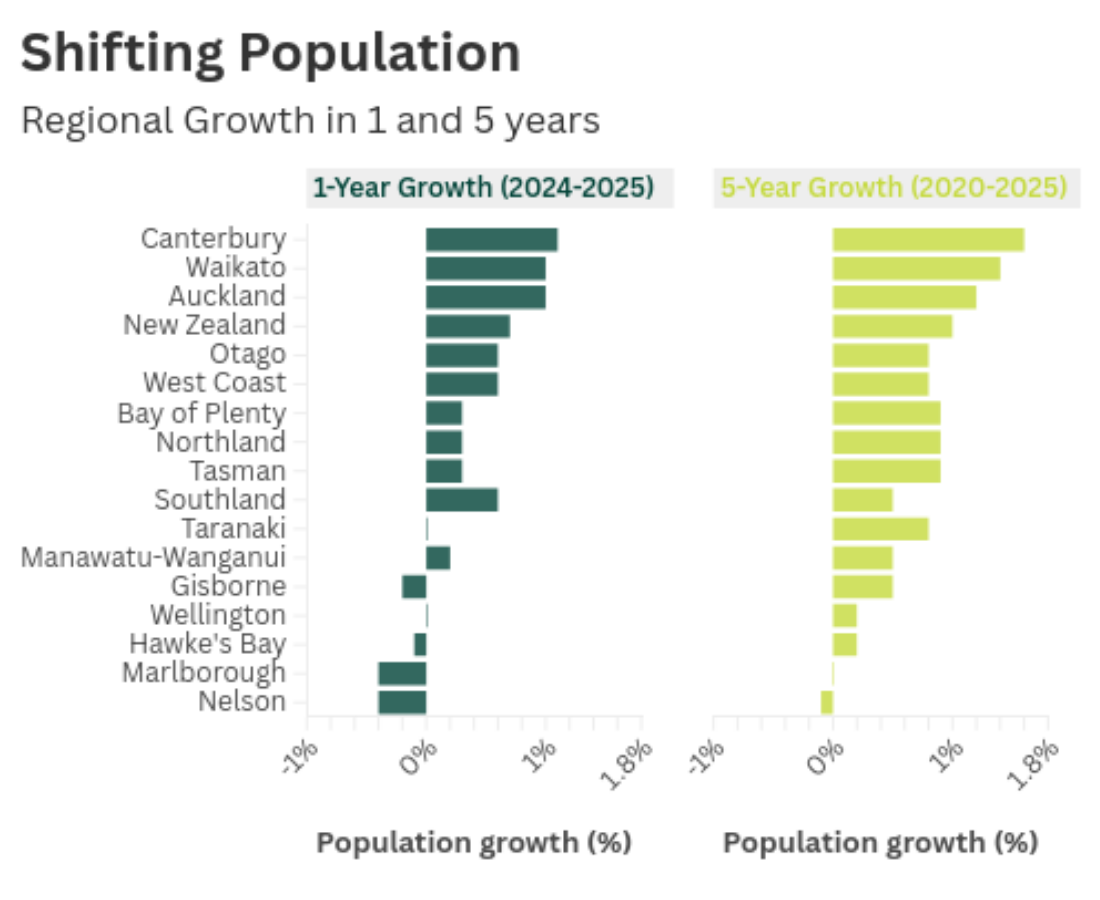

Population growth slows – what it means for Northland

Northland’s population grew by only 700 people in the past year, reaching 201,100 as of 30 June 2025. That is an increase of 0.3 percent, down from 1.2 percent in 2024. Over the past five years, growth has averaged 0.9 percent per year, which is slightly below the national rate of 1 percent. This places Northland sixth highest among New Zealand’s regions for growth.

Regional population growth in New Zealand: Canterbury, Waikato and Auckland lead, with Northland recording the sixth fastest growth in the five year period. Nelson shows slight decline.

Population trends

- Current population: 201,100 (as at 30 June 2025)

- Annual growth: +700 people (+0.3%), down from +1.2% in 2024

- Five-year trend: +0.9% per year (2020–25), compared with +2.3% per year in 2015–20

- National comparison: Northland ranks sixth for growth over the past decade (1.6%), behind Waikato (1.9%) and Canterbury (1.6%).

Northland accounts for 3.8 percent of New Zealand’s 5.32 million residents. Only Auckland, Waikato, and Canterbury grew by more than 1 percent per year between 2020 and 2025. Nelson is the only region that experienced a population decline since 2020.

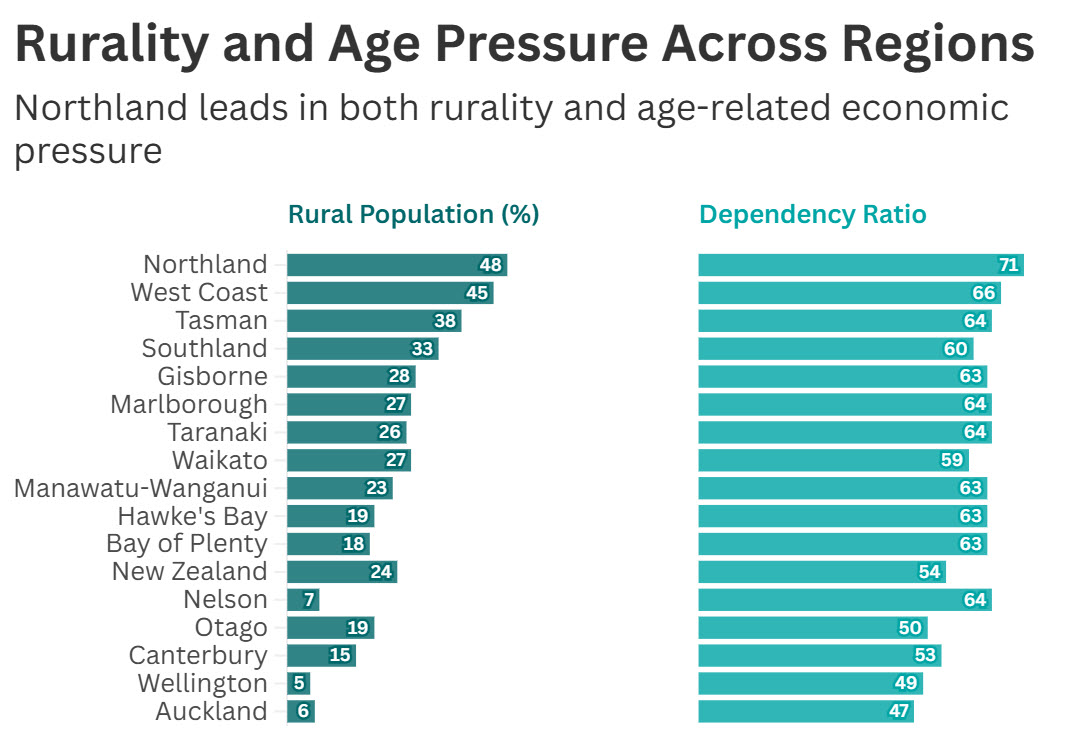

Age and dependency

Northland has the highest dependency ratio in the country. Forty-one percent of residents are either under 15 or over 65. The national average is 35 percent. This means there are 71 dependents for every 100 working-age people, compared with 54 nationally.

This age mix puts pressure on health care, aged care, and education services. It also limits the size of the workforce. Planning for jobs and services needs to take this into account.

District differences

Population distribution within Northland:

- Whangārei: 50%

- Far North: 37%

- Kaipara: 13%

Growth since 2020:

- Kaipara: +1.4% per year (fastest)

- Whangārei: +0.8%

- Far North: +0.8%

Of the 8,400 people added between 2020 and 2025:

- Whangārei: 45%

- Far North: 33%

- Kaipara: 21%

Rural and urban living

Northland is New Zealand’s most rural region, with 48 percent of people living in rural areas compared to 15 percent nationally. The West Coast (45%) and Tasman (38%) follow closely, while urbanisation dominates in Wellington (95%), Auckland (94%), and Nelson (93%).

This rural–urban divide highlights the diverse settlement patterns across the motu. For Northland, it means infrastructure, service delivery, and economic development must suit rural communities from transport and digital connectivity to health and housing.

Northland has the highest proportion of rural residents and age-related dependency ratio in New Zealand, followed by West Coast and Tasman.

What it means for the future

Northland’s population is still growing, but the pace has slowed. The region faces unique challenges:

- A high dependency ratio that strains health, education, and aged care services

- Rural settlement patterns that require tailored infrastructure and service delivery

- These trends show the need for targeted investment in rural health, housing, and jobs, along with urban planning and workforce development.

Disclaimer: This e-newsletter provides general information on the Northland economy and the views expressed are those of the authors. It is not intended for any course of action nor as a substitute for financial advice.